Recruitment Notification Out for IFSCA Officer Grade-A (Assistant Manager)-2024

Click here for the registration link!

Important dates

| Important Events | Dates |

| Commencement of on-line registration of application | 28/03/2024 |

| Closure of registration of application | 21/04/2024 |

| Closure for editing application details | 21/04/2024 |

| Last date for printing your application | 06/05/2024 |

| Online Fee Payment | 28/03/2024 to 21/04/2024 |

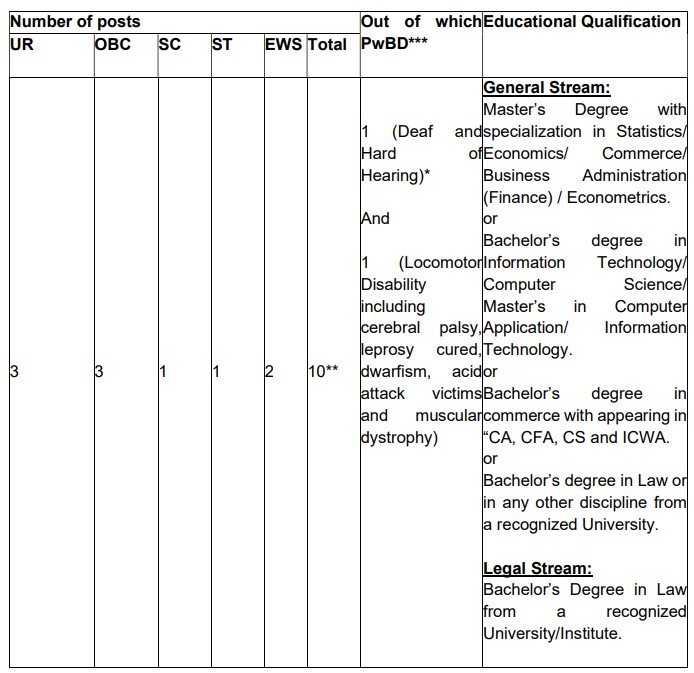

Vacancy

Considering the current recruitment notification for Officer Grade-A (Assistant Manager) as only the 2nd such recruitment notification released by IFSCA, the vacancy is still very less- Only 10. Last year, the vacancy was 20.

It is understood as the organization itself is pretty young and needs organizational restructuring. But rest assured, the department is bound to grow in future and we can expect regular notification for the post of Officer Grade-A (Assistant Manager) for higher number of vacancies. As far as we can anticipate, more posts will be created to manage the administrative work of the organization.

Mode of Selection

The exam consists of mainly 3 stages namely:

1) Phase I On-Line Examination

2) Phase II On-Line Examination

3) Interview

Phase I On-Line Examination

The phase consists of 2 exams. The details are given in the below table.

1) Negative scoring is there for every wrong answer to a question.

2) The Phase-I is not considered while preparing the merit list i.e. this phase is a qualifying phase which is used to shortlist the candidates for Phase-II.

| Paper | Streams/ Subjects | Maximum Marks | Duration | Cut off |

| Paper 1 (Common for both streams) | Multiple choice questions General awareness (financial sector) -25 questions X 1 mark each English language – 25 questions X 1 mark each Quantitative Aptitude – 25 questions X 1 mark each Test of Reasoning- 25 questions X 1 mark each | 100 | 60 minutes | 30% |

| Paper 2 | General Stream Multiple choice questions on General knowledge, Current events of national and international importance, Economic and social development (sustainable development, poverty, inclusion, and demographics), Commerce, Accountancy, Management, Finance and costing, Indian Economy, Global Economy, Five-year plans, Central Government’s initiatives/ Schemes in the financial sector. (50 questions X 2 marks each) | 100 | 60 minutes | 40% |

| Legal Stream Multiple choice questions on Specialized subject related to stream | 100 | 60 minutes | 40% | |

| Aggregate Cut off | 40% | |||

Phase II On-Line Examination

The details are given in the below table.

1) Negative scoring is there for every wrong answer to a question.

2) Phase-II consists of 2 papers. Paper- 1 is descriptive in nature and Paper-2 is MCQ based. However, there is a section cut-off of 30% and 40% respectively.

3) While Phase-I is qualifying in nature, Phase-II is considered for the shortlisting the candidates for interview as well as for preparing the merit list.

| Paper | Streams/ Subjects | Maximum Marks | Duration | Cut off | Weightage |

| Paper 1 (Common for both Streams) | English (Descriptive Test) Precis Writing – 35 marks Essay writing – 30 marks Comprehension- 35 marks | 100 | 60 minutes | 30% | 1/3rd |

| Paper 2 | General Stream Multiple choice questions on subjects like IFSCA Act, Union Budget, Economic Survey, Banking, Capital Market, Insurance, Pension Funds, Bullion, GIFT City, GIFT IFSC, IFSCA, Global Financial Centres etc. (50 questions X 2 marks each) | 100 | 60 minutes | 40% | 2/3rd |

| Legal Stream Multiple choice questions on Specialized subject related to stream. | 100 | 60 minutes | 40% | 2/3rd | |

| Aggregate Cut off | 40% | ||||

Interview

1) Only the shortlisted candidates are called for the interview.

2) The weightage of Phase-II and Interview is 85% and 15% respectively while preparing the final merit list.

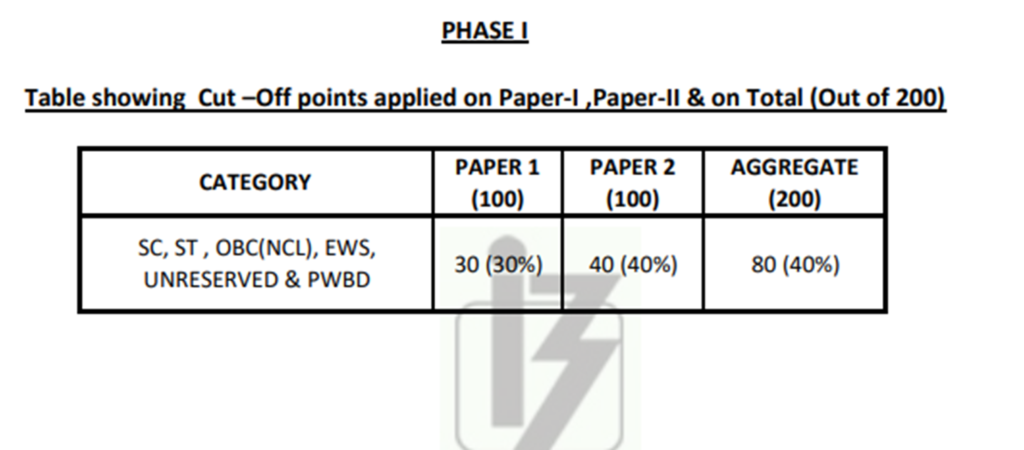

Cut-Off for IFSCA Grade-A exam- 2023

As can be seen from the below given tables, the cut off of the IFSCA Grade-A (Assistant Manager) is fairly clear. In Phase-I, aggregate of 40% is required but this phase is primarily a qualifying exam in nature.

The category wise cut-off of Phase-II exam is also attached for reference. The cut-off gives a rough idea about the competitiveness of the exam but since it is only the 2nd time the exam is conducted, the cut-off marks may increase as more number of candidates will appear this time.

Salary and allowances

IFSCA Grade-A Assistant Manager post offers a very competitive salary for an entry level exam. The salary is almost comparable to the RBI Grade-B officer and SEBI Grade-A Officer.

The selected candidate will have a monthly salary including the allowances such as Grade allowance, Special Allowance, Dearness Allowance, Family allowance, etc of around 1.43lakh per month which translates into the CTC of around 17LPA.

Apart from the salary, the selected candidates are also eligible for various benefits such as Education allowance, Book Grant, LTC, Briefcase allowance, etc.

Overall, It is a wonderful opportunity to begin a career.

Syllabus

General Stream: Syllabus for Paper 2 of Phase I :

1) General knowledge, Current events of national and international importance

2) Economic and social development (sustainable development, poverty, inclusion, and demographics)

(i) Growth and Development

a) Measurement of growth: National Income and per capita income

b) Poverty Alleviation and Employment Generation in India

c) Sustainable Development and Environmental issues.

(ii) Social Structure in India

a) Multiculturalism

b) Demographic Trends

c) Urbanization and Migration

d) Gender Issues – Social Justice

3) Commerce and Accountancy

(i) Accounting as a financial information system;

(ii) Accounting Standards with specific reference to Accounting for Depreciation, Inventories, Revenue Recognition, Fixed Assets, Foreign Exchange Transactions, Investments.

(iii) Cash Flow Statement, Fund flow statement, Financial statement analysis; Ratio analysis;

(iv) Accounting for Share Capital Transactions including Bonus Shares, Right Shares.

(v) Employees Stock Option and Buy-Back of Securities.

(vi) Preparation and Presentation of Company Final Accounts

4) Management

(i) Management: its nature and scope; The Management Processes; Planning, Organization, Staffing, Directing and Controlling;

(ii) The Role of a Manager in an Organization. Leadership: The Tasks of a Leader;

(iii) Leadership Styles; Leadership Theories; A successful Leader versus an effective Leader.

(iv) Human Resource Development: Concept of HRD; Goals of HRD;

(v) Motivation, Morale and Incentives: Theories of Motivation; How Managers Motivate; Concept of Morale; Factors determining morale; Role of Incentives in Building up Morale.

(vi) Communication: Steps in the Communication Process; Communication Channels; Oral versus Written Communication; Verbal versus non-verbal Communication; upward, downward and lateral communication; Barriers to Communication, Role of Information Technology.

(vii) Corporate Governance: Factors affecting Corporate Governance; Mechanisms of Corporate Governance

5) Finance

(i) Financial System

a) Role and Functions of Regulatory bodies in Financial Sector.

(ii) Financial Markets

a) Primary and Secondary Markets (Forex, Money, Bond, Equity, etc.), functions, instruments, recent developments.

(iii) General Topics

a) Basics of Derivatives: Forward, Futures and Swap

b) Recent Developments in the Financial Sector

c) Financial Inclusion- use of technology

d) Alternate source of finance, private and social cost-benefit, Public-Private Partnership

e) Direct and Indirect taxes; Non-tax sources of Revenue, GST, Finance Commission, Fiscal Policy, Fiscal Responsibility and Budget Management Act (FRBM),

f) Inflation: Definition, trends, estimates, consequences, and remedies (control): WPI, CPI – components and trends.

g) Financial Risk Management

6) Costing

(i) Overview of Cost and Management Accounting – Introduction to Cost and Management Accounting, Objectives and Scope of Cost and Management Accounting.

(ii) Methods of Costing – Single Output/ Unit Costing, Job Costing, Batch Costing, Contract Costing, Process/ Operation Costing, Costing of Service Sectors.

(iii) Basics of Cost Control and Analysis – (i) Standard Costing, (ii) Marginal Costing, (iii) Budget and Budgetary Control.

(iv) Lean System and Innovation:-

a) Introduction to Lean System

b) Just-in-Time (JIT)

c) Kaizen Costing

d) 5 Ss

e) Total Productive Maintenance (TPM)

f) Cellular Manufacturing/ One-Piece Flow Production Systems

g) Six Sigma (SS)

h) Introduction to Process Innovation and Business Process Re-engineering (BPR).

7) Indian Economy & Global Economy

(i) Demand and Supply, Market Structures, National Income: Concepts and Measurement, Classical & Keynesian Approach Determination of output and employment, Consumption Function, Investment Function, Multiplier and Accelerator, Demand and Supply for Money , IS – LM, Inflation and Phillips Curve, Business Cycles

(ii) Balance of Payments, Foreign Exchange Markets, Inflation, Monetary and Fiscal Policy, Non-banking Financial Institutions.

(iii) Role of International Financial Institutions: BIS, IOSCO, IMF & World Bank.

8) Central Government’s initiatives/ Schemes in the financial sector.

General Stream: Syllabus for Paper 2 of Phase II:

- IFSCA Act, IFSCA, IFSC, GIFT IFSC, GIFT City and Global Financial Centres

- Union Budget — Concepts, approach and broad trends & Economic Survey

- Banking

(i) Structure and Functions of Financial Institutions

(ii) Functions of Reserve Bank of India

(iii) Banking System in India – Structure and Developments, Financial Institutions – SIDBI, EXIM Bank, NABARD, NHB, NaBFID etc.

(iv) Recent Developments in Global Financial System and its impact on Indian Financial System

(v) Role of Information Technology in Banking and Finance

(vi) Non-Banking System

(vii) Developments in Digital Payments - Capital Market

(i) Role and Functions of Regulatory bodies in Financial Sector.

(ii) Primary and Secondary Markets (Forex, Money, Bond, Equity, etc.), functions, instruments, recent developments

(iii) Basics of Derivatives: Forward, Futures and Swap

(iv) Spot and Derivative market of Precious Metals - Insurance

(i) History of Indian Insurance, principles of Insurance;

(ii) Risk and uncertainty, pooling and diversification of risk, Indemnity and Insurable interest;

(iii) Legal foundations of Insurance, basics in Group/Health Insurance/Pensions; Intermediation: role in mobilising savings, evolution of various types and Bancassurance in India;

(iv) Functions performed by Insurers: Product design, pricing, distribution, underwriting, claims, Investment and Reinsurance;

(v) Insurance lines and products: Property-Liability, Life Insurance and Annuities and Health Insurance; Liability risks and Insurance, valuation and Solvency requirements, Specialist Insurance lines in India – Agricultural and Export Credit Guarantee; Reinsurance, GIC of India, obligator sessions and retention of risk within the Country. - Pension Sector

(i) Status of pension sector in India

(ii) Types of retirement schemes in India and their features

(iii) National Pension System

(iv) Atal Pension Yojana

(v) Annuity Plans

(vi) Basics of investment