The Payment of Bonus Act 1965

In this article, we have covered the Payment of Bonus Act 1965 in detail. The Act has been broken down in a very simple way to understand the basic structure of the Act. We believe that this is possibly the only article on internet to cover The Payment of Bonus Act 1965 in such a lucid way. So be patient as it will be a lengthy article and scroll down to all the sections. But trust me, all the fear related to the Act will disappear once you start learning the things correct way. This Act doesn’t have chapter like other Acts but only the sections which makes this Act as one of the easiest to understand.

In Brief!

So, if we have to summarize the entire Act in the most simplest way to give you an idea of what is coming below, then simply The Payment of Bonus Act of 1965 mandates that employers in India pay bonuses to employees based on their profits or productivity. It applies to establishments with 20 or more employees and covers those earning up to a specified salary limit. The Act sets a minimum and maximum percentage of wages as bonus, ensuring workers share in the profits of the company. Employers must distribute the bonus within eight months of the financial year’s end.

Section-1: Application of Act

- This Act is called the Payment of Bonus Act, 1965.

- It applies to the whole of India.

- It covers:

- (a) every factory,

- (b) every other establishment with twenty or more employees on any day during the accounting year.

- Even if the number of employees drops below twenty, the establishment must still follow this Act.

NOTE: Section-2 of all the Acts talks about the definition of various terminologies used in the Act.

Section-4: Computation of Gross Profits

The employer must calculate the gross profits for any accounting year as follows:

(a) For a banking company, use the method in the First Schedule.

(b) For any other establishment, use the method in the Second Schedule.

Section-5: Computation of Available Surplus

The available surplus in respect of any accounting year shall be the gross profits for that year after deducting therefrom the sums the taxes and other necessary deductions on part of the employer.

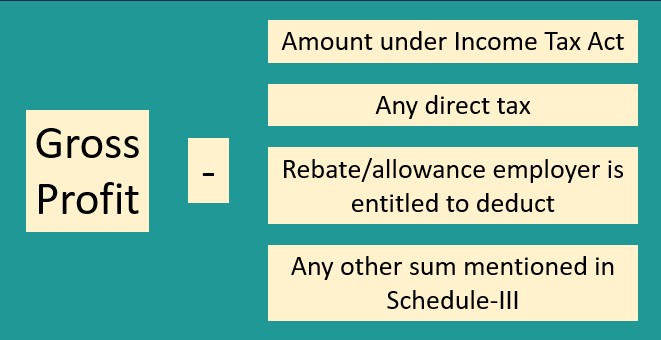

Section-6: Sums deductible from gross profits

Gross profit-Amount under Income tax Act- Rebate/allowance employer is entitled to deduct-any direct tax-Any other sum mentioned in Schedule-III

Section-7: Calculation of direct tax payable by the employer

The employer must calculate any direct tax payable for an accounting year using the applicable rates. While calculating, they should not consider:

- Losses from previous years carried forward.

- Arrears of depreciation that can be added to future allowances.

- Exemptions or deductions under certain sections of the Income-tax Act before the 1965 Finance Act.

- Rebate or relief in the payment of direct tax allowed under any law.

Section-8: Eligibility for bonus

Every employee is entitled to receive a bonus from their employer in an accounting year if they have worked at least thirty days in that year.

Section-9: Disqualification for bonus

An employee cannot receive a bonus if they are dismissed for:

(a) fraud,

(b) riotous or violent behavior on the premises,

(c) theft, misappropriation, or sabotage of the establishment’s property.

Section-10: Payment of minimum bonus

Every employer must pay each employee a minimum bonus of 8.33% of their salary or one hundred rupees, whichever is higher, regardless of allocable surplus in the accounting year.

Section-11: Payment of maximum bonus

If the allocable surplus is more than the minimum bonus, the employer must pay each employee a bonus proportional to their salary, up to a maximum of 20% of their salary or wage for the accounting year.

Section-12: Calculation of bonus with respect to certain employees

If an employee’s salary exceeds seven thousand rupees, the employer must calculate the bonus as if the salary were seven thousand rupees.

Section-13: Proportionate reduction in bonus in certain cases

If an employee has not worked for all the working days in an accounting year, the minimum bonus of one hundred rupees or, if applicable, sixty rupees (whichever is higher than 8.33% of their salary or wage for the days worked) will be reduced proportionately.

Section-14: Computation of number of working days

For the purposes of section 13, an employee will be considered to have worked in an establishment in any accounting year on days when:

(a) They have been laid off according to an agreement or as permitted by standing orders under the Industrial Employment (Standing Orders) Act, 1946, or the Industrial Disputes Act, 1947, or any other applicable law.

(b) They have taken leave with salary or wage.

(c) They have been absent due to temporary disablement from a work-related accident.

(d) They have been on maternity leave with salary or wage during the accounting year.

Section-15: Set on and set off of allocable surplus

If the allocable surplus for any accounting year exceeds the maximum bonus payable to employees under section 11, the excess amount, up to a limit of twenty percent of the total salary or wage of employees in that establishment for that year, will be carried forward for payment in subsequent accounting years. This process continues for up to four accounting years, as illustrated in the Fourth Schedule.

If for any accounting year there is no available surplus or the allocable surplus is insufficient to cover the minimum bonus payable to employees under section 10, and there is no sufficient amount carried forward from previous years to cover this deficiency, then the minimum amount or shortfall will be carried forward to be offset in the succeeding accounting year. This process also continues for up to four accounting years, as illustrated in the Fourth Schedule.

Section-17: Adjustment of customary or interim bonus

If in any accounting year:

(a) An employer has paid any puja bonus or other customary bonus to an employee; or

(b) An employer has paid a part of the bonus payable under this Act to an employee before the due date,

then the employer can deduct the amount already paid from the total bonus amount due under this Act for that year, and the employee will receive only the remaining balance.

Section-18: Deduction of certain amounts from bonus payable under the Act

If, in any accounting year, an employee is found guilty of misconduct causing financial loss to the employer, the employer can deduct the amount of loss from the bonus payable to the employee under this Act for that year, and the employee will receive the remaining balance, if any.

Section-19: Time-limit for payment of bonus

All amounts payable to an employee as bonus under this Act must be paid in cash by the employer:

(a) Within one month from the date on which the award becomes enforceable or the settlement comes into operation, if there is a dispute pending before any authority under section 22.

(b) Otherwise, within eight months from the end of the accounting year.

Section-21: Recovery of bonus due from an employer

If an employee or their authorized representative, or in case of the employee’s death, their assignee or heirs, believes they are owed bonus money under a settlement, award, or agreement from their employer, they can apply to the appropriate Government for recovery. If the Government confirms the amount is due, it will issue a certificate to the Collector, who will recover it like an arrear of land revenue. Applications must be made within one year from when the money became due, but may be considered later with valid reasons accepted by the Government.

Section-22: Reference of disputes under the Act

If there is a dispute between an employer and employees regarding the bonus payable under this Act or its application to a public sector establishment, it will be considered an industrial dispute under the Industrial Disputes Act, 1947.

Section-23 to 26: Maintenance of records, registers,etc

Every employer shall maintain the register and records in the manner as prescribed. The documents such as Balance sheet, Profit and loss statement, audited bank account of the establishment is presumed to be accurate and shall not be questioned.

Section-27: Inspectors

The appropriate Government can appoint Inspectors through a notification in the Official Gazette for enforcing this Act.

Inspectors can: (a) Request employers to provide necessary information. (b) Enter establishments or related premises at reasonable times, with assistance if needed, and ask those in charge to produce and allow examination of accounts, books, registers, and other documents related to employment, salary, or bonus. (c) Question employers, their agents, servants, or anyone in charge, as well as individuals believed to be or have been employees, about relevant matters. (d) Make copies or extracts from books, registers, or documents maintained in relation to the establishment. (e) Exercise other powers as prescribed.

Anyone requested by an Inspector under subsection (1) to produce documents or provide information is legally obligated to comply.

Section-28: Penalty

If any person:

(a) Violates any provision of this Act or any rule made under it; or

(b) Fails to comply with a direction or requisition issued under this Act,

they can be punished with imprisonment for up to six months, or a fine of up to one thousand rupees, or both.

Section-29: Offences by companies

If a company commits an offence under this Act, every person who was in charge of and responsible for the company’s business at the time of the offence, along with the company itself, will be considered guilty of the offence and can be prosecuted and punished accordingly. However, a person can avoid punishment if they prove that the offence occurred without their knowledge and that they took all reasonable steps to prevent it.

Section-31A: Special provision with respect to payment of bonus linked with production or productivity

Employees are entitled to receive the bonus due to them under any agreement or settlement, whether made before or after the commencement of the Payment of Bonus (Amendment) Act, 1976 (23 of 1976), if it provides for an annual bonus linked to production or productivity instead of the bonus based on profits as stipulated in this Act.

Want to explore other topics?

-

Factories Act 1948 for APFC, ALC, JRF, EO/AO exams by UPSC

Factories Act 1948 for APFC, ALC, JRF, EO/AO exams by UPSC -

UPSC Civil Services Exam

UPSC Civil Services Exam -

Syllabus for DRDO SAO (Senior Administrative Officer) Grade-II

Syllabus for DRDO SAO (Senior Administrative Officer) Grade-II -

DRDO Senior Administrative Officer(UPSC)- notification, syllabus

DRDO Senior Administrative Officer(UPSC)- notification, syllabus -

Everything about UPSC

Everything about UPSC -

The Payment of Bonus Act 1965 for various exams such as APFC, EO/AO, ALC, JRF

The Payment of Bonus Act 1965 for various exams such as APFC, EO/AO, ALC, JRF -

National Parks in India

National Parks in India -

Definitions and purpose of Marketing

-

Study Material for DRDO SAO

Study Material for DRDO SAO